When taking out a Car Title Loan Decatur TX, missed payments can lead to swift repossession. To avoid this, borrowers should communicate with lenders promptly and understand their rights under Texas law. After repossession, individuals can rebuild credit by disputing errors, applying for secured cards, and exploring alternative financing like Bad Credit Loans Decatur TX.

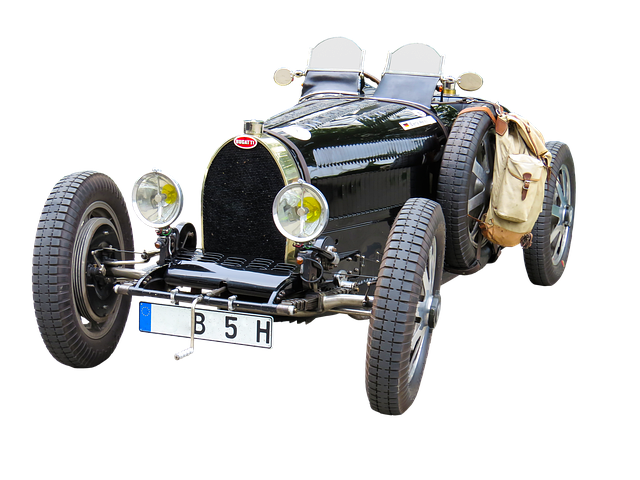

If your car has been repossessed after taking out a car title loan in Decatur, Texas, it can feel overwhelming. This guide helps you navigate the situation by understanding the process and your legal rights. We break down the next steps to take, including what to expect during and after repossession. Furthermore, we offer strategies for rebuilding your credit score post-repossession, empowering you to make informed financial decisions in the future regarding car title loans Decatur TX.

- Understanding Car Repossession After Title Loans

- Legal Rights and Next Steps After Repossession

- Rebuilding Credit Post-Car Repossession in Decatur TX

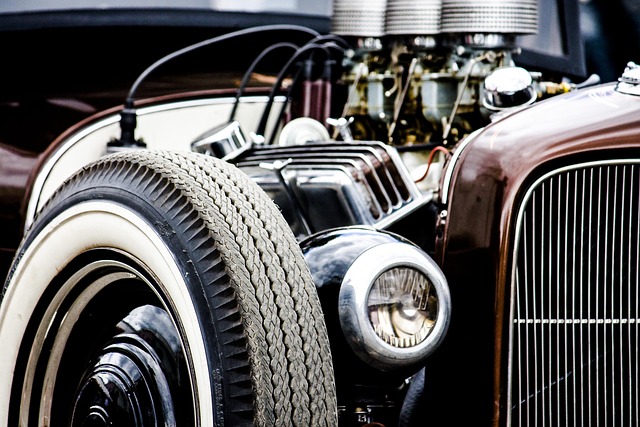

Understanding Car Repossession After Title Loans

When you take out a car title loan, the lender secures the debt by placing a lien on your vehicle’s title. If you fail to make the required payments, the lender has the legal right to repossess your car to recover the outstanding balance. This process can happen quickly, especially with shorter-term loans like Car Title Loans Decatur TX. It’s important to understand that repossession is a serious matter and can have significant consequences for borrowers.

If you’re facing potential repossession due to missed payments on your title loan in Fort Worth or Decatur, it’s crucial to act fast. Contact your lender immediately to discuss repayment options and explore strategies to prevent the repossession process. Remember, timely communication is key to resolving such situations. Additionally, understanding the terms of your loan agreement and exploring alternatives like secured loans or same-day funding (offered by some lenders) can help borrowers steer clear of this stressful situation.

Legal Rights and Next Steps After Repossession

After your car has been repossessed due to non-payment of Car Title Loans Decatur TX, understanding your legal rights and available next steps is crucial. In Texas, borrowers have specific protections under state laws that govern secured loans and repossession procedures. The first step is to gather all necessary documents related to the loan agreement, including any communication from the lender or repossession company. Reviewing these documents can help you understand your rights and options, such as disputing the repossession if there were procedural errors.

Contacting a legal professional who specializes in consumer debt rights, especially those with expertise in Car Title Loans Decatur TX, is advisable. They can guide you on how to proceed, whether it’s negotiating with the lender for repayment plans or exploring options to retrieve your vehicle. Remember, while lenders offer fast cash solutions through title loans with flexible payment plans and no credit check, repossession is a serious matter that requires immediate attention to protect your legal interests.

Rebuilding Credit Post-Car Repossession in Decatur TX

After a car repossession due to Car Title Loans Decatur TX, rebuilding your credit might seem daunting, but it’s achievable with the right steps. The first priority is to understand your rights and the process involved in recovering your vehicle. Once settled, start by obtaining a copy of your credit report from major credit bureaus to identify any errors or discrepancies. This step is crucial as it allows you to dispute inaccurate information that may be impacting your score.

Consider applying for a secured credit card or becoming an authorized user on someone else’s account with good standing. These options can help demonstrate responsible borrowing to creditors. Additionally, explore alternatives like Bad Credit Loans in Decatur TX, which offer Same Day Funding and could provide the financial flexibility you need to keep your vehicle. Remember, rebuilding credit takes time, so remain patient and consistent in managing your new accounts responsibly.

If your car has been repossessed due to a Car Title Loan in Decatur, TX, it can be a challenging situation. However, understanding your legal rights and taking proactive steps to rebuild your credit is crucial for moving forward. After ensuring the process adheres to Texas state laws, focus on creating a plan to regain financial stability and explore options to recover your vehicle or secure alternative transportation. Remember, rebuilding credit takes time, but with dedication, you can restore your financial health and avoid future repossession issues related to Car Title Loans in Decatur, TX.