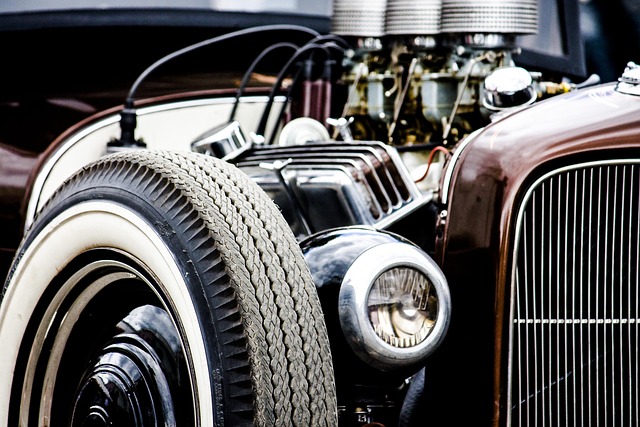

Car title loans Decatur TX offer secured funding using a vehicle's title as collateral, providing fast cash for unexpected expenses. Borrowers keep ownership but transfer registration to the lender until repayment. Transparency and careful review of terms are crucial; a vehicle inspection determines the loan amount. While attractive for poor credit, these loans require understanding repayment conditions to maintain vehicle ownership.

Car title loans Decatur TX have gained popularity as a quick source of cash for vehicle owners. However, understanding their impact on your rights is crucial. This article delves into the intricacies of car title loans in Decatur TX, exploring how they influence vehicle registration and ownership. We’ll also guide you through preserving your rights during the loan process, ensuring you stay in control of your asset. By the end, you’ll have a comprehensive understanding of this alternative financing option.

- Understanding Car Title Loans Decatur TX

- Impact on Vehicle Registration and Ownership

- Preserving Your Rights in the Loan Process

Understanding Car Title Loans Decatur TX

Car title loans Decatur TX are a form of secured lending where individuals use their vehicle’s title as collateral to secure a loan. This type of loan is designed for those who need quick funding and have a clear car title in their name. The process involves pawning the vehicle’s title to the lender, allowing them to hold onto it until the loan is repaid. Despite this, borrowers retain ownership rights, making it different from traditional car loans where the dealership holds the title.

One of the key advantages of Car title loans Decatur TX is the flexibility they offer. Borrowers can typically choose from a range of payment plans tailored to their financial capabilities, ensuring manageable monthly installments. This accessibility makes it an attractive option for individuals seeking a fast and convenient solution for unexpected expenses or emergency funds, providing them with quick funding when traditional banking options may not be readily available.

Impact on Vehicle Registration and Ownership

When you secure a car title loan in Decatur TX, the lender temporarily takes over the vehicle’s registration and ownership rights as collateral for the loan. This means that while you retain physical possession of your vehicle, the lender has legal claim to its ownership until the loan is fully repaid. The process typically involves using the vehicle’s title, which proves ownership, as security for the loan. This shift in ownership rights can impact various aspects of your vehicle experience.

For instance, altering the vehicle’s registration may be necessary to reflect the new financial arrangement. During the loan period, you’ll usually need to keep the lender informed about any changes, such as updates to your contact details or address. Additionally, if you decide to sell or trade-in the vehicle during the loan term, you must inform the lender and ensure that they’re satisfied with the new ownership arrangements before proceeding. This is because until the car title loan Decatur TX is repaid, the lender retains a significant interest in the vehicle’s value and its future disposition.

Preserving Your Rights in the Loan Process

When considering a Car Title Loan Decatur TX, it’s vital to understand that this type of loan uses your vehicle’s title as collateral. While this can provide access to quick funding, it’s crucial to preserve your rights throughout the process. This means ensuring transparency from the lender and understanding all terms and conditions before signing any paperwork. A thorough Vehicle Inspection is typically conducted to assess your car’s value, which directly impacts the loan amount offered.

For individuals with less-than-perfect credit, Car Title Loans Decatur TX can be an attractive option, especially when compared to traditional Bad Credit Loans in San Antonio. However, you should always review the terms and conditions carefully. Repayment schedules, interest rates, and potential penalties for early repayment or default are all essential factors that impact your rights and financial obligations. By staying informed and asking questions, you can protect yourself and maintain control over your vehicle ownership rights throughout the loan period.

Car title loans Decatur TX can provide a quick financial solution, but understanding their impact on vehicle ownership rights is crucial. While these loans offer accessibility, borrowers must remain vigilant to protect their rights regarding vehicle registration and future use. By staying informed and adhering to legal guidelines, individuals can navigate this process securely, ensuring they retain full control over their assets.